When you finance a vehicle, understanding the terms of your loan can save you thousands of dollars. One of the most important concepts to grasp is the principal. Many car buyers focus solely on monthly payments without realizing how the principal affects the total cost of their vehicle. This article will explain what principal means in auto financing and how it impacts your car loan.

Understanding Principal in Auto Loans

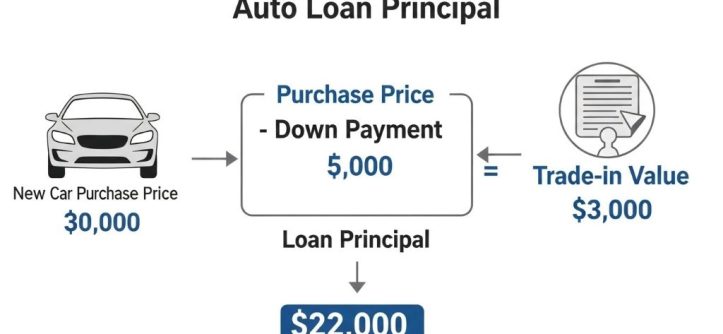

The principal is the original amount of money you borrow to purchase a vehicle. In other words, it represents the actual cost of the car minus any down payment you make. For example, if you buy a car priced at $30,000 and make a $5,000 down payment, your principal loan amount would be $25,000.

This amount forms the foundation of your loan agreement. Additionally, it determines how much interest you will pay over the life of the loan. The principal does not include interest charges, fees, or any other costs associated with borrowing money. Therefore, understanding this distinction is crucial for managing your auto loan effectively.

How Principal Differs from Interest

Many borrowers confuse principal with the total amount they will repay. However, these are two separate components of your auto loan. The principal is what you borrowed initially, while interest is the cost of borrowing that money.

Lenders charge interest as a percentage of the principal amount. For instance, if you have a $20,000 principal with a 5% annual interest rate over five years, you will pay interest on top of that $20,000. Consequently, your total repayment amount will be significantly higher than the original principal.

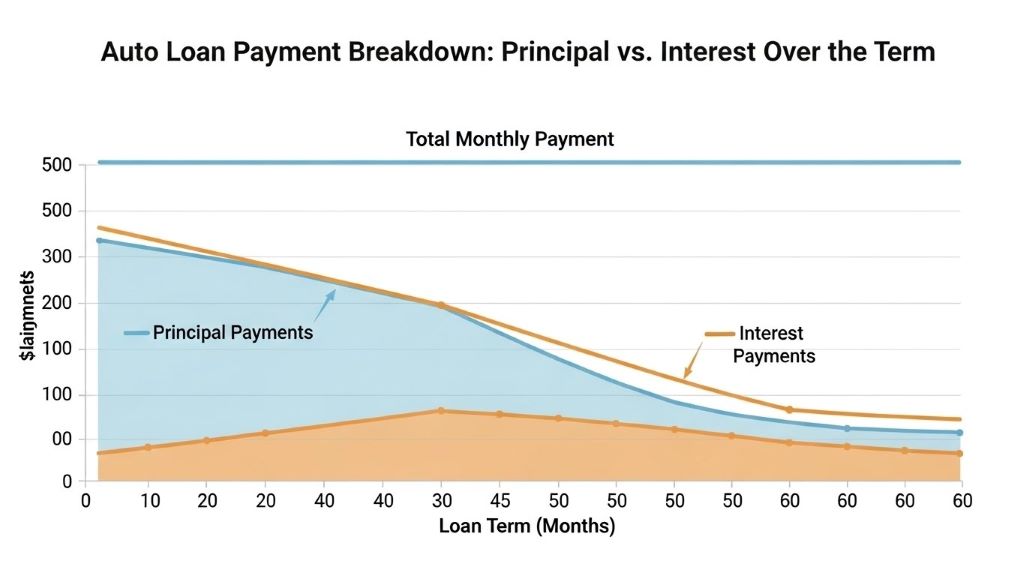

Each monthly payment you make typically contains both principal and interest portions. Early in the loan term, a larger portion goes toward interest. As time progresses, more of your payment applies to the principal balance.

Calculating Your Auto Loan Principal

Determining your principal amount is straightforward. Start with the vehicle’s purchase price, then subtract your down payment and any trade-in value. The remaining amount represents your principal.

Let’s consider a practical example. Suppose you want to buy a car listed at $28,000. You have $3,000 saved for a down payment, and your current vehicle has a trade-in value of $2,000. Your calculation would look like this: $28,000 minus $3,000 minus $2,000 equals $23,000. Therefore, your principal loan amount would be $23,000.

Some buyers also choose to finance additional costs like extended warranties or gap insurance. These add-ons increase your principal amount. However, financing these extras means you will pay interest on them throughout the loan term.

Why Principal Matters in Car Financing

The principal amount directly affects several aspects of your auto loan. First, it determines your monthly payment size. A larger principal results in higher monthly payments, assuming all other factors remain constant.

Moreover, the principal influences the total interest you will pay. Interest accrues based on the outstanding principal balance. Consequently, a higher principal means more interest charges over time. According to Consumer Financial Protection Bureau, understanding your loan terms helps you make better financial decisions.

Your principal also affects your loan-to-value ratio. This ratio compares your loan amount to the vehicle’s worth. A high ratio can make refinancing more difficult and may leave you underwater on your loan if the car’s value depreciates quickly.

Reducing Your Principal Amount

Several strategies can help you lower your principal and save money on your auto loan. The most effective method is making a larger down payment. A substantial down payment reduces the amount you need to borrow, which decreases both your monthly payments and total interest costs.

Additionally, trading in a vehicle with positive equity can reduce your principal. If your current car is worth more than you owe on it, you can apply that difference toward your new vehicle purchase. This approach effectively lowers the amount you need to finance.

Shopping for the best vehicle price also impacts your principal. Negotiating a lower purchase price means you borrow less money. Therefore, spending time researching and comparing prices can lead to significant savings.

Principal Payments and Loan Amortization

Auto loans typically follow an amortization schedule. This schedule shows how each payment is divided between principal and interest over the loan term. Understanding amortization helps you see how your principal balance decreases over time.

In the beginning, your payments primarily cover interest charges. However, as you continue making payments, the principal portion gradually increases. This shift occurs because interest is calculated on the remaining principal balance, which decreases with each payment.

Furthermore, making extra principal payments can accelerate your loan payoff. When you pay more than the required monthly amount and specify that the extra goes toward principal, you reduce your outstanding balance faster. This strategy can save you substantial interest charges.

Impact of Loan Term on Principal

The loan term length affects how quickly you pay down your principal. Shorter loan terms mean higher monthly payments but faster principal reduction. Conversely, longer terms offer lower monthly payments but slower principal payoff.

A typical auto loan ranges from 36 to 72 months, though some lenders offer terms up to 84 months. While extended terms make monthly payments more affordable, they also mean you pay interest on the principal for a longer period. As noted by Edmunds, longer loan terms can significantly increase the total cost of vehicle ownership.

Choosing the right loan term requires balancing affordability with total cost. A shorter term saves money on interest but demands higher monthly payments. Therefore, consider your budget and financial goals when selecting a loan term.

Refinancing and Principal Balance

Refinancing involves replacing your current auto loan with a new one, ideally at a better interest rate. Your principal balance at the time of refinancing becomes the principal for your new loan. However, you cannot refinance more than your current principal balance unless you have negative equity.

Many borrowers refinance to secure lower interest rates or adjust their loan terms. This strategy can reduce monthly payments or help pay off the principal faster. Nevertheless, refinancing works best when you have built equity in your vehicle and improved your credit score.

Additionally, timing matters with refinancing. Refinancing too early might result in prepayment penalties from your original lender. Therefore, review your current loan agreement before pursuing refinancing options.

Common Mistakes with Principal in Auto Loans

Many car buyers make errors that negatively impact their principal and overall loan cost. One common mistake is rolling negative equity from a previous vehicle into a new loan. This practice increases your principal beyond the new car’s actual value, putting you in a difficult financial position.

Another mistake involves financing unnecessary add-ons. Dealerships often promote products like paint protection or fabric guards. While these might seem appealing, financing them increases your principal and the interest you pay.

Furthermore, some buyers accept whatever loan terms dealerships offer without shopping around. Different lenders provide varying interest rates and terms. Therefore, comparing multiple loan offers can help you secure better financing and reduce your principal-related costs.

Conclusion

Understanding principal in auto loans empowers you to make smarter financing decisions. The principal represents the actual amount you borrow, and it directly impacts your monthly payments, total interest costs, and overall loan affordability. By making larger down payments, negotiating better vehicle prices, and choosing appropriate loan terms, you can minimize your principal and save money.

Remember that every dollar you reduce from your principal translates to interest savings over the loan’s life. Whether you are buying your first car or your fifth, keeping the principal amount as low as possible should be a priority. Take time to calculate your principal, understand your loan terms, and explore strategies to pay down your balance faster.

Frequently Asked Questions

What happens if I make extra principal payments on my auto loan?

Making extra principal payments reduces your outstanding loan balance faster. This strategy decreases the total interest you pay over the loan term and can help you own your vehicle outright sooner. Most lenders allow extra principal payments without penalties, but always verify your loan terms first.

Can I negotiate the principal amount on an auto loan?

You cannot directly negotiate the principal with your lender, but you can reduce it by negotiating a lower vehicle purchase price, increasing your down payment, or applying trade-in equity. These actions lower the amount you need to borrow, effectively reducing your principal.

Does refinancing change my principal balance?

Refinancing uses your current outstanding principal balance as the basis for your new loan. The principal amount stays the same unless you borrow additional money or have fees added to the new loan. Refinancing primarily changes your interest rate and loan term.

How does depreciation affect my auto loan principal?

Depreciation affects your vehicle’s value but not your principal balance. Your principal remains what you borrowed regardless of the car’s current worth. However, if your car depreciates faster than you pay down the principal, you may end up owing more than the vehicle is worth.

Is it better to have a low principal with high interest or high principal with low interest?

Generally, a low principal with higher interest is better than a high principal with low interest. A smaller principal means you borrow less money overall. Even with a slightly higher rate, you will likely pay less total interest on a smaller borrowed amount compared to a larger one with a marginally lower rate.

Related Topics:

Leave a Reply